Special Offers

New FMLA Forms with ...

New FMLA Forms with FCCRA Guidelines as Per DOL

$199.00

The Department of Labor (Department) is seeking information from the public regarding the regulation..

New IRS Form 1099-NE...

New IRS Form 1099-NEC And Changes To 1099-MISC Tax Reporting: Major Changes to Implement in 2020

$149.00

The 1099-NEC is being reintroduced to address confusion created by the PATH (Protecting Americans fr..

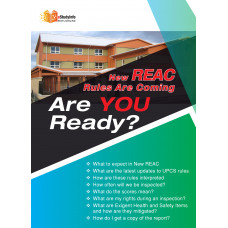

New REAC Rules Are C...

New REAC Rules Are Coming, Are You Ready?

$69.00

Under the HUD 2020 Management Reform Plan, HUD created the Real Estate Assessment Center (REAC). Par..

New Regulations for ...

New Regulations for the Pregnant Workers Fairness Act

$189.00

The less than one-year-old federal Pregnant Workers Fairness Act (PWFA) requires most employers with..

New Regulations for ...

New Regulations for the Pregnant Workers Fairness Act

$189.00

The less than one-year-old federal Pregnant Workers Fairness Act (PWFA) requires most employers with..

OSHA 300 Recordkeepi...

OSHA 300 Recordkeeping: Top Compliance Mistakes and Pain Points

$199.00

OSHA injury/illness reporting and recordkeeping requirements can be daunting even in normal times, b..

OSHA 300 Recordkeepi...

OSHA 300 Recordkeeping: Top Compliance Mistakes and Pain Points

$199.00

OSHA recordkeeping is a top pain point for employers. From deciphering the nuances of whether an inj..

OSHA’s Newly Relea...

OSHA’s Newly Released COVID-19 Guidance: How to Protect employees and Meet OSHA Requirements

$199.00

OSHA has released Guidance on Preparing Workplaces for COVID-19, which provides specific action step..

Paid Family & Si...

Paid Family & Sick Leave Amid COVID-19 Crisis: The New Families First Coronavirus Response Act &Leave Administration

$199.00

Now that the New Family First Coronavirus Response Act (FFCRA) is in place it is critical for Employ..

Partnerships and S C...

Partnerships and S Corporations: How to Calculate Basis

$159.00

The IRS has recently increased the pressure on how to calculate and report partner and shareholder b..

Partnerships and S C...

Partnerships and S Corporations: How to Calculate Basis

$159.00

The IRS has recently increased the pressure on how to calculate and report partner and shareholder b..

Partnerships and S C...

Partnerships and S Corporations: How to Calculate Basis

$159.00

The IRS has recently increased the pressure on how to calculate and report partner and shareholder b..

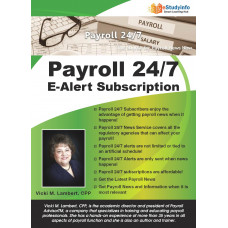

Payroll 24/7 E-Alert...

Payroll 24/7 E-Alert Subscription

$149.00

Payroll 24/7 News Service keeps you connected to the news and information you need to keep your payr..

Payroll Tax Headache...

Payroll Tax Headaches: Understanding and Resolving Common Issues

$189.00

Payroll taxes are one thing that all businesses have in common. Dealing with payroll tax headaches c..

Penalty Games: Reduc...

Penalty Games: Reducing IRS Penalties

$149.00

Each day the Internal Revenue Service asserts millions of dollars in tax penalties against taxpayers..