Special Offers

Corporate Transparen...

Corporate Transparency Act: The Final FinCEN Rule

$149.00

With the formal implementation of the US Corporate Transparency Act (CTA) on 1 January 2024, most bu..

Correctly Responding...

Correctly Responding to IRS Notices: Protect Your Clients Rights

$149.00

Hundreds of thousands of IRS letters go out each year and you are the first one your client will tur..

COVID-19 Outbreak: H...

COVID-19 Outbreak: How To Handle Maintenance Requests And Protect Multifamily Staff ?

$199.00

The recent crisis of the coronavirus Disease (COVID-19) calls for enhanced cooperation between publi..

Cut That Tax Debt by...

Cut That Tax Debt by a Third: How to Cancel Penalty and Interest Assessments

$69.00

Does your client qualify for a penalty abatement or a refund of paid penalties?IRS penalties and int..

Cut That Tax Debt by...

Cut That Tax Debt by a Third: How to Cancel Penalty and Interest Assessments

$149.00

Does your client qualify for a penalty abatement or a refund of paid penalties?IRS penalties and int..

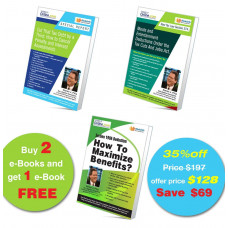

Cut That Tax Debt by...

Cut That Tax Debt by a Third: How to Cancel Penalty and Interest assessments and Amended Code Section 274 Pack of 3 eBook

$128.00

Cut That Tax Debt by a Third: How to Cancel Penalty and Interest Assessments (e-Book size: 8 x ..

Dealing With IRS Pas...

Dealing With IRS Passport Revocation: Understand How to Request a Reversal

$149.00

The IRS has had the legal authority to cause one’s passport (PP) to be revoked in the case of a “ser..

Dealing With IRS Pas...

Dealing With IRS Passport Revocation: Understand How to Request a Reversal

$149.00

The IRS has had the legal authority to cause one’s passport (PP) to be revoked in the case of a “ser..

Demystifying Form 10...

Demystifying Form 1040: A Comprehensive Guide to Filing Your Taxes

$159.00

Form 1040 is the standard U.S. individual income tax return form that taxpayers use to report their ..

Developing a Mainten...

Developing a Maintenance Plan for Multi-Family Properties

$199.00

Learn how to develop an effective maintenance plan for multi-family properties, so you can reduce co..

EEOC Pandemic Prepar...

EEOC Pandemic Preparedness in the Workplace: Learn how Employers Should Prepare the Workplace for the New Normal

$199.00

In response to COVID-19, the Equal Employment Opportunity Commission (EEOC) has updated and/or provi..

Effective Strategies...

Effective Strategies for Couples to Maximize Social Security Planning

$149.00

Planning for Social Security can be complex, especially for couples who want to maximize their benef..

Effective Strategies...

Effective Strategies for Couples to Maximize Social Security Planning

$149.00

Planning for Social Security can be complex, especially for couples who want to maximize their benef..

Employer Taxation an...

Employer Taxation and Withholding: Changes to Form W-4 and Form 941 and Other New Reporting Requirements

$179.00

Recent months have brought significant changes to employers’ withholding and payroll reporting requi..

Estate and Income Ta...

Estate and Income Tax Planning for the Surviving Spouse

$159.00

Losing a spouse is not only a traumatic emotional event, but it also wreaks havoc on the surviving s..